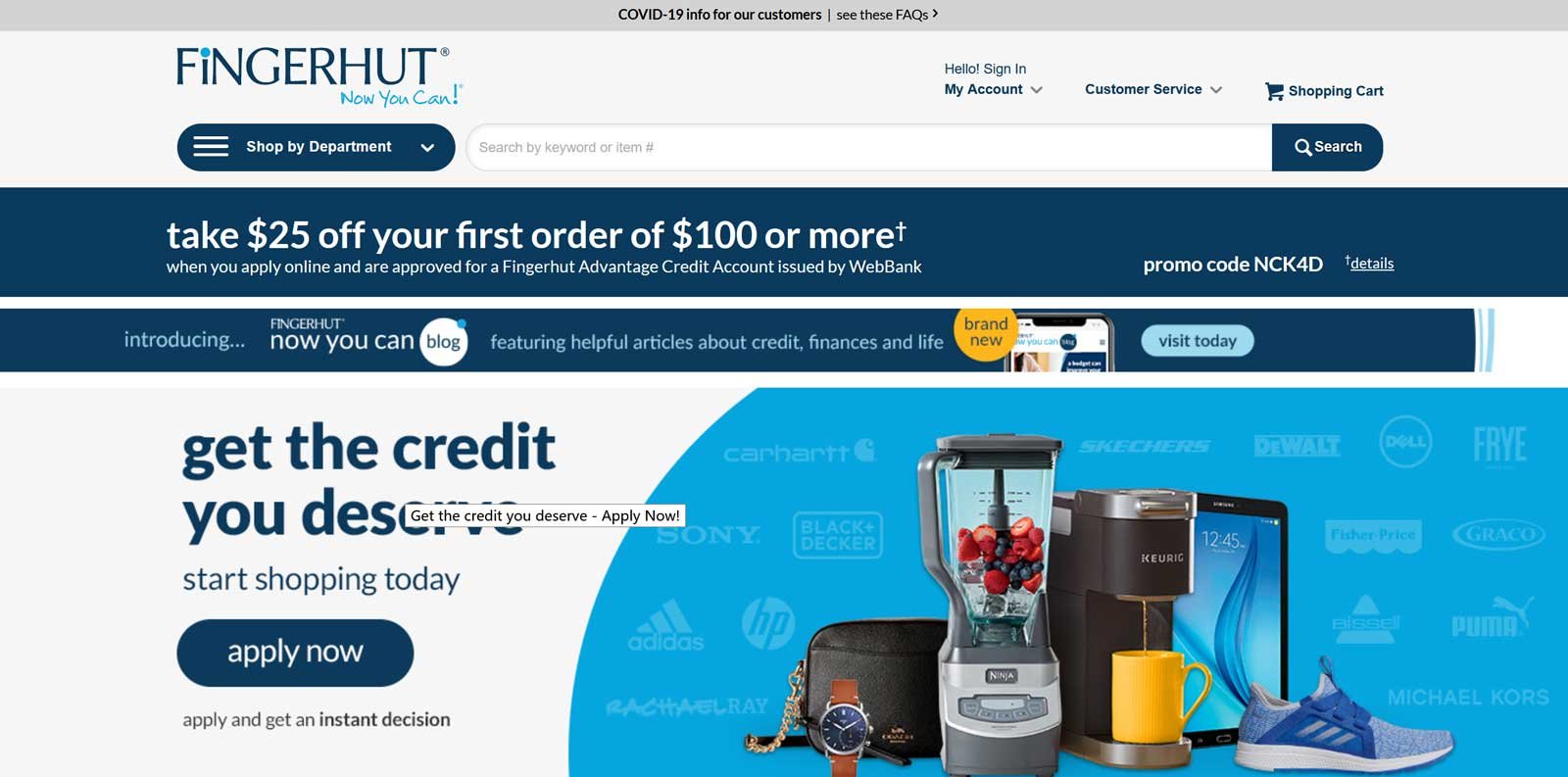

Sites Like Fingerhut No Credit Check: Your Ultimate Guide To Shopping Without Credit Worries

Ever felt like you needed that perfect item but got held back by credit checks? Well, you're not alone. Many people today are looking for sites like Fingerhut that don't run credit checks. These platforms offer a great way to shop for what you need without the stress of credit scores. In this article, we'll dive deep into the world of no-credit-check shopping and help you find the best alternatives to Fingerhut.

Imagine being able to buy that new TV or laptop without worrying about your credit history. Sounds too good to be true? It’s not! There are plenty of online stores out there offering flexible payment options, and we’re here to break it all down for you. Whether you're looking for tech gadgets, home appliances, or fashion items, we’ve got you covered.

But hold up! Before we jump into the nitty-gritty, let’s clarify something. Not all sites claiming to be like Fingerhut deliver on their promises. That’s why we’ve done the legwork for you, researching the best options, comparing features, and bringing you the ultimate guide. So, buckle up and let’s get started!

Read also:Understanding Arthritis Medication Relief And Management For A Better Quality Of Life

What Are Sites Like Fingerhut No Credit Check?

First things first, what exactly does it mean when we talk about "sites like Fingerhut no credit check"? Simply put, these are online stores that allow you to make purchases without running a hard credit check. Instead, they often use alternative methods to assess your ability to pay, such as reviewing your employment history or bank account activity. This makes them ideal for people with limited or poor credit histories.

Here’s the kicker: many of these platforms also offer installment plans, so you can pay for your purchases over time. It’s a win-win situation—no credit check hassle, and you can still get what you need. But remember, while these sites don’t check your credit, they may still charge interest or fees, so it’s important to read the fine print before signing up.

Why Choose Sites That Don’t Check Credit?

Let’s face it—credit checks can be a real buzzkill. If you’ve had trouble with credit in the past, you know how frustrating it can be to get turned down for a simple purchase. That’s where sites like Fingerhut come in. Here are a few reasons why you might want to consider shopping at no-credit-check sites:

- No Hard Credit Inquiries: Your credit score remains unaffected.

- Flexible Payment Options: Pay over time with manageable installments.

- Wide Range of Products: From electronics to furniture, you’ll find everything you need.

- Convenience: Shop from the comfort of your home without the hassle of visiting physical stores.

But here’s the deal: while these sites are convenient, they’re not without their downsides. Some may charge higher interest rates or have strict return policies, so it’s always a good idea to do your research before committing to a purchase.

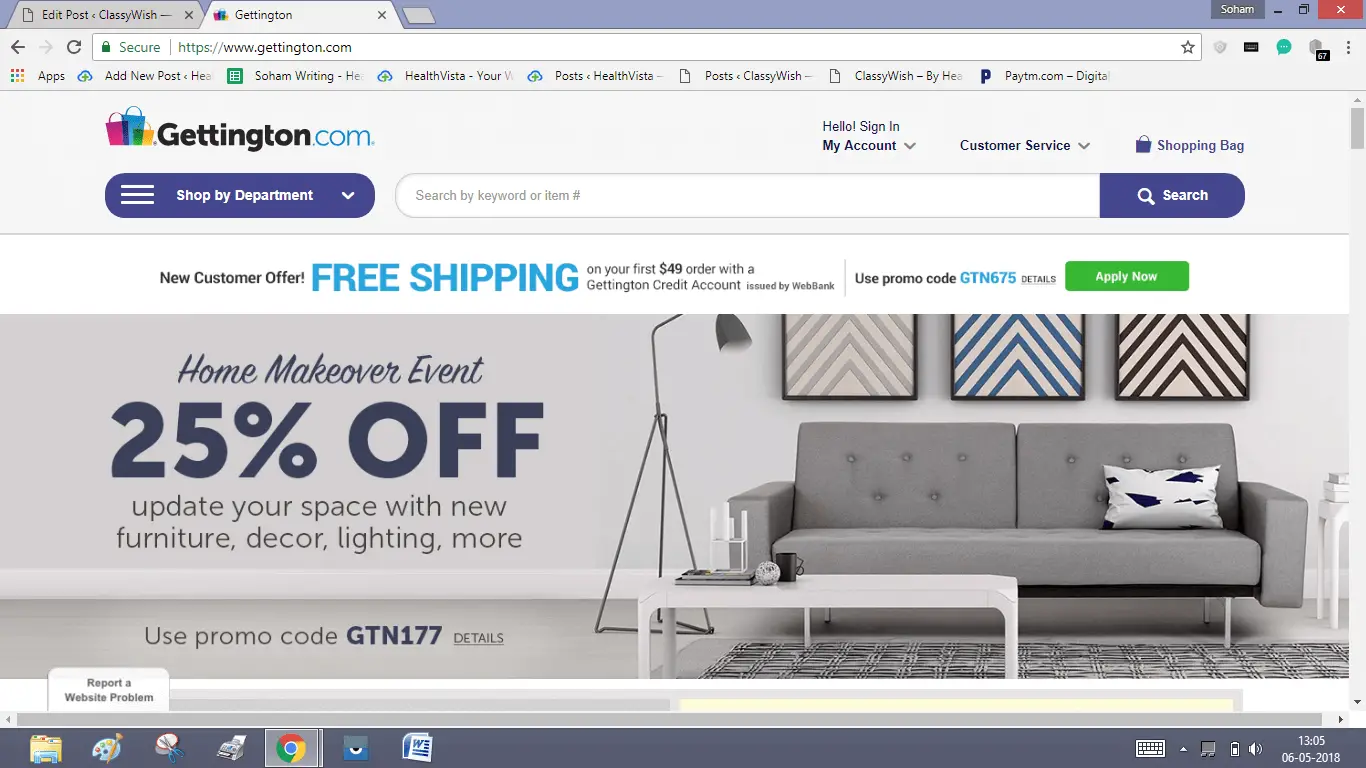

Top Sites Like Fingerhut No Credit Check

Now that you know why these sites are worth considering, let’s take a look at some of the best options available. Here’s a quick rundown of the top contenders:

1. Zibby

Zibby is one of the most popular alternatives to Fingerhut. It offers a wide range of products, from electronics to home goods, all without requiring a credit check. Plus, they provide flexible payment plans, making it easy to budget your purchases.

Read also:Tom Burke Height In Feet A Comprehensive Look At The Actors Stature And Career

2. Affirm

Affirm partners with various retailers to offer interest-free installment plans. While they do perform a soft credit check, it won’t impact your credit score. This makes Affirm a great option for those looking to avoid traditional credit checks.

3. Bread

Bread is another fantastic option for no-credit-check shopping. They work with retailers to offer installment loans, often with no interest charges. Just like Affirm, Bread performs a soft credit check, which doesn’t affect your credit score.

How Do These Sites Work?

So, how exactly do these no-credit-check sites operate? Most of them use alternative methods to assess your financial stability, such as:

- Employment Verification: They may check your employment status to ensure you have a steady income.

- Bank Account Review: Some platforms review your bank account activity to gauge your ability to make payments.

- Payment History: If you’ve used the platform before, they might look at your past payment behavior.

Once they’ve determined your eligibility, you’ll be able to shop and pay for your purchases using the payment plan of your choice. It’s a straightforward process that takes the stress out of shopping.

What to Look for in a No-Credit-Check Site

With so many options available, it’s important to know what to look for when choosing a no-credit-check site. Here are a few key factors to consider:

- Product Range: Does the site offer the items you’re looking for?

- Payment Terms: Are the payment plans flexible and affordable?

- Customer Reviews: What do other users have to say about their experience?

- Return Policy: Is the return policy reasonable and easy to understand?

Remember, not all sites are created equal. Take the time to compare your options and choose the one that best meets your needs.

Common Misconceptions About No-Credit-Check Sites

There are a few common misconceptions about no-credit-check sites that we need to address. Here are a couple of the big ones:

1. They’re Only for People with Bad Credit

Not true! While these sites are a great option for people with poor credit, they’re also perfect for those who simply prefer not to use credit cards. Whether you’re building credit or avoiding debt, these platforms can be a valuable resource.

2. They’re More Expensive

While some no-credit-check sites may charge higher interest rates, many offer competitive pricing and even interest-free options. It all depends on the site and the specific product you’re purchasing.

Benefits of Shopping Without Credit Checks

Shopping without credit checks comes with a host of benefits. Here are just a few:

- No Impact on Credit Score: Since these sites don’t perform hard credit checks, your credit score remains unaffected.

- Flexible Payment Plans: Pay over time with manageable installments, making it easier to budget.

- Wide Selection: Many of these sites offer a wide range of products, from electronics to fashion.

But here’s the thing: while these benefits are great, it’s still important to shop responsibly. Always make sure you can afford the payments before making a purchase.

Challenges and Considerations

Of course, no system is perfect. Here are a few challenges and considerations to keep in mind when shopping at no-credit-check sites:

- Potentially Higher Interest Rates: Some sites may charge higher interest rates, so it’s important to read the terms carefully.

- Strict Return Policies: Not all sites have lenient return policies, so be sure to check before you buy.

- Payment Delays: If you miss a payment, it could affect your ability to shop with the site in the future.

Despite these challenges, the benefits often outweigh the drawbacks, especially for those who need flexible payment options.

How to Shop Responsibly on No-Credit-Check Sites

Shopping responsibly is key to making the most of no-credit-check sites. Here are a few tips to help you stay on track:

- Stick to Your Budget: Only buy what you can afford to pay back comfortably.

- Read the Fine Print: Make sure you understand the payment terms and any fees involved.

- Track Your Payments: Keep a record of your payments to avoid missing any deadlines.

By following these simple tips, you can enjoy the convenience of no-credit-check shopping without the stress of financial strain.

Final Thoughts and Call to Action

So, there you have it—your ultimate guide to shopping on sites like Fingerhut without credit checks. Whether you’re looking for electronics, home goods, or fashion, these platforms offer a convenient and stress-free way to get what you need. Just remember to shop responsibly and always read the fine print.

Now it’s your turn! Have you tried any of the sites we mentioned? What was your experience like? Leave a comment below and let us know. And if you found this article helpful, don’t forget to share it with your friends and family. Happy shopping!

Table of Contents

- Sites Like Fingerhut No Credit Check: Your Ultimate Guide to Shopping Without Credit Worries

- What Are Sites Like Fingerhut No Credit Check?

- Why Choose Sites That Don’t Check Credit?

- Top Sites Like Fingerhut No Credit Check

- How Do These Sites Work?

- What to Look for in a No-Credit-Check Site

- Common Misconceptions About No-Credit-Check Sites

- Benefits of Shopping Without Credit Checks

- Challenges and Considerations

- How to Shop Responsibly on No-Credit-Check Sites